UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment (Amendment No. )

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| Preliminary Proxy Statement | |

| ||

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material Pursuant to §240.14a-12 | |

Brown-Forman Corporation

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check the appropriate box): | |||||

| No fee required. | ||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

| (1) | Title of each class of securities to which transaction applies: | ||||

| (2) | Aggregate number of securities to which transaction applies: | ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | ||||

| (4) | Proposed maximum aggregate value of transaction: | ||||

| (5) | Total fee paid: | ||||

| Fee paid previously with preliminary materials. | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount Previously Paid: | ||||

| (2) | Form, Schedule or Registration Statement No.: | ||||

| (3) | Filing Party: | ||||

| (4) | Date Filed: | ||||

2017 PROXY

STATEMENT

2015 PROXY STATEMENT & NOTICE OF ANNUAL SHAREHOLDER

MEETING

WE ENRICH THE EXPERIENCE OF LIFE BY RESPONSIBLY BUILDING BEVERAGE ALCOHOL BRANDS THAT THRIVE AND ENDURE FOR GENERATIONS.

June 23, 2015

DEAR BROWN-FORMAN STOCKHOLDER:

It is our pleasure to invite you to attend Brown-Forman Corporation’s 20152017 Annual Meeting of Stockholders, which will be held at the Brown-Forman Conference Center in Louisville, Kentucky, onThursday, July 23, 201527, 2017, at 9:30 A.M. (Eastern Daylight Time). Please see the Notice of Annual Meeting on the next page for more information about this location and our admission procedures.

Your vote is important to us.If you are a Class A stockholder, weWe urge you to complete and return your proxy card or to vote by telephone or online as soon as possible, whether or noteven if you plan to attend the Annual Meeting.

We hope to see you on July 23.27. On behalf of the Board of Directors, thank you for your continued support.

Very truly yours,

|

|

Paul C. Varga,

Geo. Garvin Brown IV,

Chairman of the Board of Directors

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 23, 2015:

The Notice of Annual Meeting, Proxy Statement, and Annual Report to Stockholders, which includes our Form 10-K for fiscal 2015, are available atwww.brown-forman.com/proxy.

We are holding this meeting for the following purposes:

»

| • | To elect the thirteen directors named in |

| • | To vote, on a nonbinding advisory basis, to approve our executive compensation; |

| • | To vote, on a nonbinding advisory basis, on the frequency of future advisory votes on executive compensation; and

|

| • | To transact any other

|

Class A stockholders of record at the close of business on June 19, 2017, are entitled to vote at the meeting, either in person or by proxy. Class B stockholders are welcome to attend the meeting but are not entitled to vote at the meeting, either in person or by proxy.

There are several ways to vote.

There are several ways to vote this year. You may complete, sign, and date the enclosed proxy card and return it promptly in the enclosed envelope, or you may vote by telephone (1-800-652-8683) or online(www.investorvote.com/BFB). Whatever method you choose, please vote in advance of the meeting to ensure that your shares will be voted as you direct. Instructions on telephone and online voting are on the proxy card enclosed with this Proxy Statement.

Louisville, Kentucky

June 27, 2017

By order of the Board of Directors

Matthew E. Hamel, Secretary

ADMISSION PROCEDURES

We are committed to providing a safe, secure environment for our stockholders, employees, and guests. To that end, please vote in advance of the meeting to ensure that your shares will be voted as you direct. Instructions on telephone and online voting are on the proxy card enclosed with this Proxy Statement.

Louisville, Kentucky

June 23, 2015

By order of the Board of Directors

Matthew E. Hamel, Secretary

ADMISSION PROCEDURES

As we are committed to providing a safe, secure environment for our stockholders, employees, and guests, we kindly ask that you observe the following procedures if you plan to attend the Annual Meeting:

»

| • | Before the

|

| • | When you

|

| • | What to bring:Everyone attending the meeting should bring

|

If you do not register in advance, you may still be admitted if you present a photo ID along with your proxy card, brokerage statement, or other documentation of stock ownership.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 27, 2017:

The Notice of Annual Meeting, Proxy Statement, and Annual Report to Stockholders, which includes our Form 10-K for fiscal 2017, are available atwww.brown-forman.com/ investors/annual-report/.

| TABLE OF CONTENTS |

|  | 1 |

| ||||

In this section we highlight certain information about matters discussed in this Proxy Statement. As it is only a summary, we encourage you to read the entire Proxy Statement before voting.

ANNUAL MEETING OF STOCKHOLDERS

| Date: | Thursday, July 27, 2017 | Location: | Brown-Forman Conference Center |

| 850 Dixie Highway | |||

| Time: | 9:30 A.M. | ||

| (Eastern Daylight Time) | |||

| Louisville, Kentucky 40210 | |||

PROPOSAL

PROPOSALS FOR STOCKHOLDER VOTING

| Proposal | Our Board’s voting recommendation | Where to find details | ||

| Election of 13 directors | Pages | |||

| Advisory vote to approve our executive compensation | FOR the proposal | Page 51 | ||

| Advisory vote on the frequency of future advisory votes on executive compensation | For EVERY THREE YEARS as the frequency offuture advisory votes on executive compensation | Page 52 |

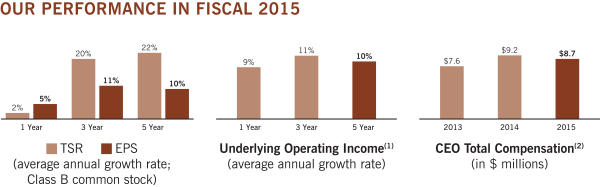

PERFORMANCE AND COMPENSATION HIGHLIGHTS

We believe that our executive compensation program continues to attract, motivate, reward, and retain a talented and diverse team of executives. These individuals lead us in our efforts to be the best brand builder in the spirits industry, and enable us to deliver superior and sustainable value for our stockholders. We had strong performance during fiscal 2015, and theThe incentive payouts to our executives described in this Proxy Statement reflect this performance.our performance during fiscal 2017.

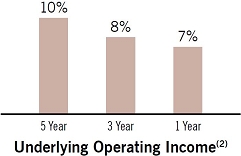

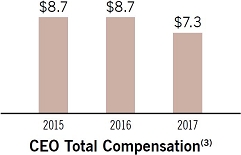

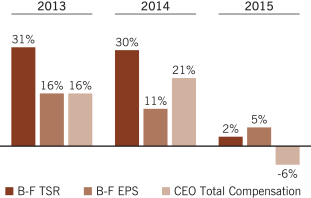

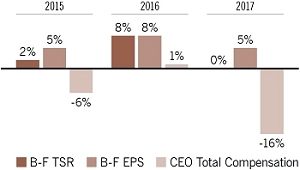

The following charts compare our Companytrends in Brown-Forman’s performance with respect to total shareholder return, diluted earnings per share, and underlying operating income(1) growth with trends in the compensation of our Chief Executive Officer, Paul C. Varga. These metrics reflect exceptional long-term value generated for our stockholders, and the charts show the alignment ofhow our compensation strategy aligns with that performance.

|  |  | ||

| (compound annual growth rate; Class B common stock) | (compound annual growth rate) | (in $ millions) |

| (1) | EPS was adjusted to exclude the effect of acquired and divested brands in fiscal 2016 and fiscal 2017. These measures remove the effects of (a) the gain on the sale of Southern Comfort and Tuaca, (b) those transaction-related costs not included in the gain on the sale of Southern Comfort and Tuaca, (c) financing-related costs for the acquisition of BenRiach, and (d) operating activity for the acquired and divested businesses in the non-comparable periods. (With respect to the comparison of fiscal 2017 to fiscal 2016, the non-comparable period comprised all months of both years.) EPS used for fiscal 2016 was $1.63, compared to the reported GAAP value of $2.61, and EPS used for fiscal 2017 was $1.72, compared to the reported GAAP value of $1.71. Both measures are adjusted in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” under the heading “Fiscal 2017 Highlights — Adjusted Measures for Acquired and Divested Brands.” |

| (2) | Reflects growth in “underlying operating income” over the past fiscal years. “Underlying operating income” is |

| Mr. Varga’s total compensation includes base salary, stock appreciation rights, non-equity compensation, and all other compensation as reported in the Fiscal |

| 2 |  | |||||

BROWN-FORMAN |

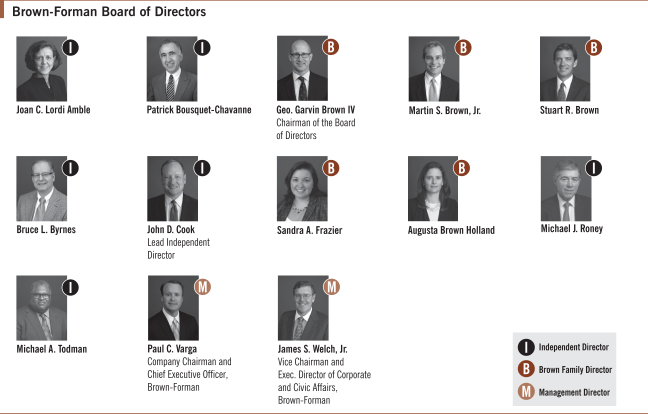

OUR DIRECTOR NOMINEES TO THE BOARD

YouClass A stockholders are being asked to vote on the election of the thirteen directors named below. More details about each director’s background, skills, and expertise can be found below under “Election“Proposal 1: Election of Directors.” Dace Brown Stubbs has decided not to seek re-election at the Annual Meeting. At the time of the Annual Meeting, the size ofDirectors” beginning on page 16. One new director, Kathleen M. Gutmann, joined the Board therefore will be reduced to thirteen directors.on May 24, 2017.

Board Nominees

| Committee Membership | ||||||||||||

Nominee Name, Age & Occupation |

| Director | Category | |||||||||

& Nom |

| |||||||||||

| Patrick Bousquet-Chavanne,AGE 59 Executive Director of Customer, Marketing and M&S.com, Marks and Spencer Group PLC |

|

| • | • | ||||||||

|

|

|

|

| ||||||||

|

| B, M |

|

| ||||||||

|

|

| ||||||||||

Geo. Garvin Brown IV,AGE 48 | 2006 | B | • | C | ||||||||

| Stuart R. Brown,AGE 52 Managing Partner, Typha Partners, LLC | 2015 | B | ||||||||||

Bruce L. Byrnes,AGE 69 | 2010 | I |

|

| ||||||||

John D. Cook,AGE 64 Director; Director Emeritus of McKinsey & Company |

|

|

|

| ||||||||

|

| • | C | • | ||||||||

| Marshall B. Farrer,AGE 46 Vice President and Managing Director of Global Travel Retail, Brown-Forman Corporation | 2016 | B, M | ||||||||||

|

| B | ||||||||||

48 |

|

|

| |||||||||

|

| I |

| |||||||||

|

|

|

| |||||||||

Founding Partner, Haystack Partners LLC |

|

|

| |||||||||

| Michael J. Roney,AGE 63 Retired Chief Executive, Bunzl plc | 2014 | I | C | |||||||||

| Michael A. Todman,AGE 59 Retired Vice Chairman, Whirlpool Corporation | 2014 | I | C | |||||||||

| Paul C. Varga,AGE 53 Chairman & CEO, Brown-Forman Corporation | 2003 | M | • | |||||||||

B=Brown Family Director M=Management Director I=Independent Director C=Chair

—“In building our brands and creating new opportunities, we are writing the next chapter in our story of innovation, perseverance, and success.”

Paul Varga, Chairman and CEO

| 19% | $561M | $274M | ||

| RETURN ON INVESTED | ||||

|

| |||

|

| |||

| (1) | Return on Invested Capital is not derived in accordance with GAAP. |

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | BROWN-FORMAN |  | 3 |

| ANNUAL MEETING INFORMATION |

ABOUT YOUR PROXY MATERIALS

Our Board of Directors is soliciting proxies for our upcoming Annual Meeting of Stockholders to be held on July 23, 201527, 2017 (the “Annual Meeting”)Annual Meeting). This means that you can vote “by proxy” at the Annual Meeting—thatMeeting —that is, you can instruct us how you would like your shares to be voted ifat the meeting whether or not you do notpersonally attend.

We are providing you with these proxythis Proxy Statement and accompanying materials to help you make an informed decision on the matters to be considered at the Annual Meeting. We will begin mailing this Proxy Statement and accompanying materials, and also make them available online, on or about June 23, 2015,27, 2017, to holders of record of our Class A and Class B common stock at the close of business on June 15, 2015,19, 2017, which is the “record date” for the Annual Meeting.

This Proxy Statement and our Annual Report to Stockholders, which includes our Form 10-K for fiscal 2015,2017, are available atwww.brown-forman.com/proxy.investors/annual-report/.You may request additional printed copies at any time using the contact information below.

Please let us know as soon as possible how you would like your shares voted. To do this, you may complete, sign, date, and return the enclosed proxy card or voting instruction card, or you may instruct us by telephone or online. See “Voting” below for details.

Contact Information

For information about your stock ownership or other stockholder services, please contact Linda Gering, our Stockholder Services Manager, by telephone at (502) 774-7690, by e-mail at Linda_Gering@b-f.com, or by mail at Brown-Forman Corporation, 850 Dixie Highway, Louisville, Kentucky 40210.

Reducing duplicate mailings. Duplicate Mailings

The Securities and Exchange Commission (SEC) permits us to deliver a single Proxy Statement and Annual Report to stockholders who share the same address and last name, unless we receive contrary instructions from any stockholder in thatthe household. EachEven if your household receives only one Proxy Statement and Annual Report, each stockholder still receives his or her ownwill receive an individual proxy card. We participate in this “householding” process to reduce our printing costs, and postage fees, and to better facilitate voting. If you would like to enroll in this “householding” service,“householding,” or if your household is already enrolled but you prefer to receive a separate copy of the proxy materials and/or opt out of “householding” for next year, please inform us using the contact information above and we will promptly fulfill your request.

ATTENDING THE ANNUAL MEETING

Although only Class A stockholders may vote at the Annual Meeting, Class A and Class B stockholders are welcome to attend if theywho owned their shares as of June 15, 2015.19, 2017, are welcome to attend.

If you plan to attend, please register on or beforeby July 21, 201525, 2017, by contacting Linda Gering using the contact information above. We ask that youPlease bring a form of photo identification to the meeting,ID and, if your shares are registered in the name of a bank, broker, or other holder of record, that you bring documentation of your stock ownership as of the date of record.record date.Please see “Admission Procedures” outlined in the Notice of Annual Meeting for full details.

VOTING

Who May Vote

If you held ourshares of Class A common stock at the close of business on the record date (June 15, 2015)19, 2017), you, or your legal proxies, may vote at the Annual Meeting on all three proposals. At the close of business on the record date, there were 169,062,117 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting. At the close of business on the record date, there were 84,528,000215,189,294 shares of Class AB common stock outstanding, andhowever those shares are not entitled to vote at the Annual Meeting.vote.

If you purchased Class A common stock after the record date, you may vote those shares only if you receive a proxy to do so from the person who held the shares on the record date. Each share of Class A common stock is entitled to one vote. If you receive more than one proxy card or voting instruction card, it is important that you should complete, sign, date, and datereturn each proxy card and each voting instruction card that you receiveone (or follow the telephone or online voting instructions) because theythe cards represent different shares.

| 4 |  | |||||

BROWN-FORMAN |

ANNUAL MEETING INFORMATION •VOTING

How to Vote

Stockholders of record:record.If you are a Class A stockholder and your shares are registered directly in your name with our stock transfer agent, Computershare, you are considered to be the “stockholder of record” of those shares. If you are a stockholder of record of Class A shares, you can give a proxy to be voted at the meeting:

Unless

• over the telephone by calling a toll-free number (1-800-652-8683);

• online(www.investorvote.com/BFB); or

• by completing, signing, and mailing the enclosed proxy card in the envelope provided.

Even if you are planningplan to vote atattend the meeting, we encourage you to submit a proxy in person, weadvance. We must receive your proxy by 1:00 a.m., Eastern Daylight Time, on Thursday, July 23, 2015.27, 2017, to ensure your vote is recorded. You may override a proxy by following the applicable procedure outlined below in “Changing Your Vote.”

The telephone and online voting procedures have been set up for your convenience and have beenare designed to authenticate your identity, to allowenable you to give voting instructions, and to confirm that those instructions have beenare recorded properly. If you are a stockholder of record and you would likewish to vote by telephone or online, please refer to the instructions set forth on the enclosed proxy card.

By giving your

Your proxy youwill authorize the individuals named on the proxy card to vote your shares for you in accordance with your instructions. These individuals will also have the obligation and authority to vote your shares as they see fit on any other matter properly presented for a vote at the Annual Meeting. If for any reason a director nominee is not available to serve, the personsindividuals named as proxy holders may vote your shares at the Annual Meeting for another nominee. The proxy holders for this year’s Annual Meeting are Geo. Garvin Brown IV, Paul C. Varga, and Matthew E. Hamel.

If you are a stockholder of record and you sign and return your proxy card (or give your proxy by telephone or online) without specifying how you want your shares to be voted, our proxy holders will vote your shares “FOR” the election of each of the nominees to the Board.Board (Proposal 1), “FOR” the advisory resolution to approve our executive compensation (Proposal 2), and for “EVERY THREE YEARS” as the frequency of future advisory votes on executive compensation (Proposal 3). With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote your shares as recommended by the Board or, if no recommendation is given, using their own discretion.

“Street name” stockholders:stockholders.If you are a Class A stockholder and your shares are held in a stock brokerage account or by a bank (known as holding shares in “street name”), you have the right to directinstruct your broker or bank how to vote your shares, and the broker or bank is required to vote your shares in accordance with your instructions. To provide those instructions to your broker or bank by mail, please complete, sign, date, and return your voting instruction card in the postage-paid envelope provided by your broker or bank. Alternatively, if the broker or bank that holds your shares offers online or telephone voting, you will receive instructionsinformation from your broker or bank that you must follow in orderabout how to submit your voting instructions online or by telephone.those methods. You also may vote in person at the meeting, but only if you obtain a “legal proxy” from the broker or bank that holds your shares.

If you are a street name stockholder and you do not instruct your broker how to vote, your broker willis not be ablepermitted to vote your shares on any of the election of directors.proposals we will address at the Annual Meeting. This is known as a “broker non-vote.”

Changing Your Vote

If you are astockholder of record, you may change your vote by submitting another proxy by telephone or online, by mailing another properly signed proxy card bearing a later date than your original one, or by attending the Annual Meeting and casting your vote in person. You also may revoke a proxy that you previously provided by delivering timely written notice of revocation of your proxy to our Secretary, Matthew E. Hamel, via mail at Brown-Forman Corporation, 850 Dixie Highway, Louisville, Kentucky 40210, or at Secretary@b-f.com.

If you hold your shares instreet name,and you will needwish to follow thechange or revoke your voting instructions, inplease refer to the materials your broker or bank has provided to you in order to change your or revoke your votingfor instructions.

Voting Privacy

Proxy instructions, ballots, and voting tabulations are handled in a manner that protects the confidentiality of each stockholder’s vote. Your vote will not be disclosed within the Company or to third parties, except as necessary to meet legal requirements, to allow for the tabulation and certification of votes, and to facilitate proxy solicitation. Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | BROWN-FORMAN |  | 5 |

ANNUAL MEETING INFORMATION •ANNOUNCEMENT OF VOTING RESULTS

Quorum Requirements

Business can be conducted at the Annual Meeting only if a quorum consisting of a majority of the outstanding shares of Class A common stock is present in person or represented by proxy. Abstentions and broker non-votes, if any, will be counted as present for purposes of establishing a quorum. Broker non-votes are counted as present for purposes of establishing a quorum but will not be considered entitled to vote on the proposal. We do not expect any broker non-votes to occur because the proposal on the agenda for this year’s Annual Meeting is a matter on which brokers do not have discretionary authority to vote.

Votes Needed For Approval

Election of directors: A nominee will be elected if he or she receives a majority of the votes cast, meaning that the number of shares voted “for” a director exceeds the number of shares voted “against” that director (with abstentions not counted as votes cast).

| Proposal | Vote required to pass | Effect of abstentions and broker non-votes | ||

| Election of directors | Nominees who receive a majority of the Class A votes cast (thenumber of shares voted “for” the nominee exceeds the number ofshares voted “against” that nominee) will be elected. | No effect. | ||

| Advisory resolution to approveexecutive compensation | Approval requires an affirmative vote of the majority of the Class Ashares present (in person or represented by proxy) and entitled to vote. | Abstentions are equivalent to votesagainstthe proposal. Broker non-votes will have no effect. | ||

| Advisory resolution on thefrequency of future advisory voteson executive compensation | The frequency receiving the greatest number of votes (every one,two, or three years) will be considered the recommendation of thestockholders. | No effect. | ||

| Any other matter | Approval requires an affirmative vote of the majority of the Class Ashares present (in person or represented by proxy) and entitled to vote. | Abstentions are equivalent to votesagainstthe proposal. Broker non-votes will have no effect. |

Any other matter properly presented and brought to a vote at the Annual Meeting: Approval requires the affirmative vote of the majority of the shares present in person or represented by proxy and entitled to vote on the matter (with abstentions counted as votes against the proposal).

Dividend Reinvestment and Employee Stock Purchase Plan Shares

Shares of Class A common stock held by participants in Brown-Forman’s dividend reinvestment and employee stock purchase plans are included in your holdings and reflected on your proxy card. These shares will be voted as you direct.

ANNOUNCEMENT OF VOTING RESULTS

We intend to announce the preliminary voting results at the Annual Meeting and to issue a press release later that day. In addition, we will report the voting results by filing a Form 8-K with the SEC within four business days following the Annual Meeting.

PROXY SOLICITATION EXPENSES

Brown-Forman bears the cost of soliciting proxies. Beginning on June 23, 2015,27, 2017, which is the mailing date for these proxy materials, our directors, officers, and other employees may solicit proxies in person or by regular or electronic mail, phone, fax, or online. Directors, officers, and employees of the CompanyThese individuals will not receive no additional compensation for soliciting proxies. We will reimburse banks, brokers, nominees, and other fiduciaries for their reasonable charges and expenses incurred in forwarding our proxy materials to the beneficial owners of our stock held in street name. In addition, we have retained Proxy Express, Inc. to assist with the distribution of proxy materials for a fee of approximately $14,000,$15,000, plus associated expenses.

| 6 |  | |||||

BROWN-FORMAN |

| CORPORATE GOVERNANCE |

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | BROWN-FORMAN |  | 7 |

CORPORATE GOVERNANCE •BOARD COMPOSITION

How Our Controlled-Company Status Affects Our Board

Our Board has determined that Brown-Forman is a “controlled company” under New York Stock Exchange (NYSE) rules because more than 50% of our Class A voting stock is held by members of the Brown family.

As a controlled company, we are exempt from NYSE listing standards that require boards to have a majority of independent directors, a fully independent nominating/corporate governance committee, and a fully independent compensation committee. As a matter of good corporate governance, the Board has voluntarily chosen to have a Compensation Committee that is composed entirely of directors who meet the NYSE’s heightened independence standards for compensation committee members. Our Board does not have a majority of independent directors or a fully independent nominating/corporate governance committee.

Our Independent Directors

Under NYSE listing rules, a director qualifies as “independent” if the board of directors affirmatively determines the director has no material relationship with the company. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships. While the focus is on independence from management, our Board considers all relevant facts and circumstances in making an independence determination. Our Board recognizes the value of having independent directors, and has determined that six directors are independent under NYSE standards: Patrick Bousquet-Chavanne, Bruce L. Byrnes, John D. Cook, Kathleen M. Gutmann, Michael J. Roney, and Michael A. Todman.

The Board has determined that Geo. Garvin Brown IV, Campbell P. Brown, Marshall B. Farrer, and Paul C. Varga are not independent because they are, or recently have been, members of Brown-Forman management. The Board elected not to make a determination with respect to the independence of Stuart R. Brown, Laura L. Frazier, and Augusta Brown Holland.

Our Brown Family Directors

We believe it is strategically important for Brown family members to be actively engaged in the oversight of Brown-Forman. Through participation on the Board, the Brown family’s long-term perspective is brought to bear, in some measure, upon each and every matter the Board considers. Brown family directors also serve as an effective link between the Board and the controlling family stockholders.

In addition, Board service allows the Brown family to actively oversee its investment in the Company. Following the Annual Meeting,Currently, the Brown family member directors are expected to be:are: Campbell P. Brown, Geo. Garvin Brown IV, Martin S. Brown, Jr., Stuart R. Brown, Sandra A.Marshall B. Farrer, Laura L. Frazier, and Augusta Brown Holland. Dace Brown Stubbs, a current Brown family director, will not stand for re-election at the Annual Meeting.

| 8 |  | BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE •BOARD COMPOSITION

Our Management Directors

The Company

We also believesbelieve it is important, from a corporate governance standpoint, that Companyfor management to be represented on the Board. Current Board members who are also members of Company management are:Currently, Campbell P. Brown, Marshall B. Farrer, and Paul C. Varga serve in dual roles as Board members and James S. Welch, Jr.Brown-Forman executives.

Recent Changes to our BoardBROWN-FORMAN BOARD OF DIRECTORS

As previously disclosed, two new directors from the Brown family, Stuart R. Brown and Augusta Brown Holland, joined the Board effective May 21, 2015. Dace Brown Stubbs, a current Brown family director, will not stand for re-election at the Annual Meeting.

| PATRICK BOUSQUET-CHAVANNE | CAMPBELL P. BROWN | GEO. GARVIN BROWN IV | |||||

| Executive Director of Customer, Marketing and M&S.com, Marks and Spencer Group PLC |  | President and Managing Director of Old Forester, Brown-Forman Corporation |  | Chairman of the Board, Brown-Forman Corporation | ||

| STUART R. BROWN | BRUCE L. BYRNES | JOHN D. COOK | |||||

| Managing Partner, Typha Partners, LLC |  | Retired Vice Chairman of the Board, The Procter & Gamble Company |  | Lead Independent Director; Director Emeritus of McKinsey & Company | ||

| MARSHALL B. FARRER | LAURA L. FRAZIER | KATHLEEN M. GUTMANN | |||||

| Vice President and Managing Director of Global Travel Retail, Brown-Forman Corporation |  | Owner and Chairman, Bittners LLC |  | Chief Sales and Solutions Officer, United Parcel Service, Inc. and Senior Vice President, The UPS Store and UPS Capital | ||

| AUGUSTA BROWN HOLLAND | MICHAEL J. RONEY | MICHAEL A. TODMAN | |||||

| Founding Partner, Haystack Partners LLC |  | Retired Chief Executive, Bunzl plc |  | Retired Vice Chairman, Whirlpool Corporation | ||

| PAUL C. VARGA | INDEPENDENT | RECENT CHANGES TO OUR BOARD As previously disclosed, Kathleen M. Gutmann joined the Board on May 24, 2017, as an independent director. | ||||

| Chairman & CEO, Brown-Forman Corporation | BROWN FAMILY | ||||

| MANAGEMENT | ||||||

| BROWN FAMILY & MANAGEMENT | ||||||

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERSBROWN-FORMAN |  | 9 |

CORPORATE GOVERNANCE •LEADERSHIP STRUCTURE

Chairman of the Board

Our Board believes that the determination of whether to separate or combine the roles of Chairman of the Board and Chief Executive Officer should depend largely upon the identity of the Chief Executive Officer and the composition of the Board at the time. For this reason, it does not have a policy on separation of these roles, but rather evaluates the situation as circumstances change.

on a case-by-case basis. Currently, these roles are separate, although they have been combined in the past. Geo. Garvin Brown IV, a Brown family member, serves as Chairman of the Board. He also serves on our Corporate Governance and Nominating Committee and the Executive Committee of the Board, which he chairs.

Company Chairman and CEO

Paul C. Varga serves as the Company Chairman and Chief Executive Officer.Officer of Brown-Forman. Mr. Varga is the Company’sour highest ranking executive officer and has responsibilityis responsible for the Company’sBrown-Forman’s strategy, operations, and performance. He serves as a member of our Board and of the Board’s Executive Committee.

Lead Independent Director

When a non-independent director holds the office of Chairman of the Board or Presiding Chairman of the Board, as is currently the case, the Board may select one independent director (after considering the recommendation of the Corporate Governance and Nominating Committee) may select one independent director to serve as Lead Independent Director. In September 2012, the Board selectedThe Lead Independent Director, if any, will be elected annually. John D. Cook to servehas served in this role.role since 2012.

As Lead Independent Director, Mr. Cook’s responsibilities are to:

| call meetings of the independent or non-management directors, when necessary or advisable; | |

| • | chair executive sessions attended solely by |

| • | facilitate open communications among directors and with management between Board meetings and help directors reach consensus on important matters; |

| • | serve as liaison, when necessary or advisable, between the Chairman of the Board or Presiding Chairman of the Board and the independent and non-management directors; |

| be available for consultation and direct communication upon the reasonable request of major and/or long-term stockholders; | |

| • | play a leadership role in contingency and succession |

| • | perform such other duties as the Board may from time to time delegate to assist the Board in the fulfillment of its responsibilities. |

Mr. Cook chaired one executive session of non-management directors in fiscal 2015.2017. Also, because our non-management director group includes directors who are not “independent” under NYSE listing standards, Mr. Cook called and presided over one executive session in fiscal 20152017 that was attended solely by our independent directors.

Why the Board Chose this Leadership Structure

OurThe Board has determined that this leadership structure currently serves the best interests of the CompanyBrown-Forman and its stockholders. Having a Brown family member serve as Chairman of the Board promotes the Brown family’s active oversight of, and engagement and participation in, the Company and its business and reflects the fact that Brown-Forman is controlled by the Brown family. In addition, because Mr. Brown handles the responsibilities attendant toassociated with the position of Chairman of the Board, Mr. Varga our Chief Executive Officer, can focus moreconcentrate on the Company’s strategy and operations, while the Board still has access to his comprehensive knowledge of the Company’s business. The Lead Independent Director position provides leadership to, and fosters coordination among, our independent directors, enabling them to better fulfill their role of bringing expert outside perspectives to the Board.

| 10 |  | BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE •BOARD GUIDELINES AND PROCEDURES

BOARD GUIDELINES AND PROCEDURES

Corporate Governance Guidelines

The Board believes that transparency is a hallmark of good corporate governance. TheTo that end, the Board has adopted Corporate Governance Guidelines that provide a framework for the Board to exercise its duties. Among other things, these guidelines contain policies and requirements regarding: director qualifications; director responsibilities, including the Lead Independent Director’s role; meetings and attendance; committee composition and responsibilities; director compensation; and director access to management and independent advisors. The guidelines also require an annual self-assessment by the Board. The Corporate Governance Guidelines are published on our website atwww.brown-forman.com/about/corporate-governancecorporate-governance/guidelines//guidelines/.

Board and Committee Self-Assessment

Each year, ourThe Corporate Governance Guidelines require the Board and eachto conduct an annual self-assessment. Each Board committee (except the Executive Committee) also annually assesses how it performed during the preceding 12 months. Thetwelve-month period. These assessment procedures they follow vary, from requiring members to complete questionnaires that call for both quantitative responses and allow for free-ranging comments, to having an independent third party interview each member and then synthesize themes that emerge.

| ||||

| ||||

Director Service

The Board is authorized to fix the numbersize of directors to serve on the Board from time to time, withinat a range ofnumber between three toand seventeen members. Directors are elected each year at the Annual Meeting by a majority of the votes cast by our Class A stockholders. Once elected, a director holds office until the next Annual Meeting of Stockholders or until his or hera successor is elected and qualified, unless he or shethe director first resigns, retires, or is removed. Directors are not subject to term limits. Alimits but a director may not stand for re-election to the Board after he or she has reachedreaching the age of 71. However, inIn exceptional circumstances, the Board may ask a director to remain on the Board until a given date if his or herthe director’s continued service would significantly benefit the Company.Brown-Forman. Service of a director beyond the age of 71 requires approval by two-thirds of the other directors following a recommendation by the Corporate Governance and Nominating Committee.Committee and the approval of two-thirds of the Board (not including the director under consideration).

Board Meetings

The Board held six regular meetings and oneno special meetingmeetings during fiscal 2015.2017. Absent an appropriate reason, all directors are expected to attend the Company’s Annual Meeting, of Stockholders, all Board meetings, and all meetings of each committee on which they serve. Each directorAll directors attended 75%90% or more of the aggregate meetings of the Board and committees on which he or shethey served during fiscal 2015.2017. All directors then serving attended the 20142016 Annual Meeting of Stockholders.

Board Committees

Our Board has the following four standing committees: Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee, and Executive Committee. Each Board committee operates under a written charter that is posted on our company website atwww.brown-forman.com/about/corporate-governance/committee-compositioncommittee-composition//. Each Board committee conducts an annual self-assessment (except the Executive Committee) and may hire independent advisors as it finds necessary or appropriate.

| AUDIT COMMITTEE | |||

| |||

| The Board has delegated to the Audit Committee responsibility for

|

| ||

| Committee Members: | ||

| • | Michael A. Todman (Chair) | ||

| • | Bruce L. Byrnes | ||

| • | John D. Cook | ||

Audit Committee members must satisfy director independence standards prescribed by the NYSE and mandated by the Sarbanes-Oxley Act. Each member of our Audit Committee satisfies all of these heightened independence standards. The Board has determined that each member of our Audit Committee is also “financially literate” within the meaning of the NYSE rules, and that Mr. Todman is an “audit committee financial expert” under SEC rules.

|  | 11 |

CORPORATE GOVERNANCE •BOARD GUIDELINES AND PROCEDURES

| COMPENSATION COMMITTEE | |||||

| The Compensation Committee’s responsibilities include Officer. | MET 6 TIMES IN FISCAL 2017 | ||||

| Committee Members: | |||||

| • | Michael J. Roney (Chair) | ||||

| • | Patrick Bousquet-Chavanne | ||||

| • | John D. Cook | ||||

| The Compensation Committee has retained 24. | |||||

| Each member of the Compensation Committee |

| ||||

The Corporate Governance and Nominating Committee’s

| MET 8 TIMES IN FISCAL 2017 | ||

| Committee Members:

| |||

| • | John D. Cook (Chair)

| ||

| • | Patrick Bousquet-Chavanne

| ||

| • | Geo. Garvin Brown IV

| ||

| • | Bruce L. Byrnes | ||

| EXECUTIVE COMMITTEE

| |||

| The Executive Committee | MET ONCE IN FISCAL 2017 | ||

| Committee Members:

| |||

| • | Geo. Garvin Brown IV (Chair)

| ||

| • | John D. Cook | ||

| • | Paul C. Varga | ||

| 12 |  | BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE •BOARD GUIDELINES AND PROCEDURES

Board’s Role in Risk Oversight

The Board believes that its current leadership structure best enables it to fulfill its risk oversight function. Our Corporate Governance Guidelines require the Board to ensure thatwe implement appropriate processes are in place for managing enterprise risk, and our Board considers risk oversight to be an integral part of its role in the Company’s strategic planning process. At its meetings, theThe Board regularly and actively considers how strategic decisions affect the Company’sBrown-Forman’s risk profile.

While the Board has ultimate oversight responsibility for the risk management process, certain committees also take onhave important supplementary roles relating to the Board’s risk oversight function.in that process. During fiscal 2015,2017, the Board tasked the followingits committees to assist it with the responsibilities outlined below:

| Audit Committee—overseeing |

| Compensation Committee—overseeing |

| Corporate Governance and Nominating Committee—overseeing |

These committees met regularly with members of management and outside advisors, as necessary, and providedreported to the Board regular reportsregularly on their risk oversight and mitigation activities. The Audit Committee discussed the Company’s enterprise risk management program with the Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, General Counsel, and Director of Internal Audit. In addition, certain management committees—themanagement’s Disclosure Controls Committee and theEnterprise Risk Committee—Management Committee both play an integral role in making sure that relevant risk-related information is reported to senior management and the Board as directly and quickly as possible. Further, our management Ethics, Compliance and Risk Team, comprising a number of senior executives and subject matter experts, meets throughout the year to address issues related to risk, ethics, and compliance; to coordinate the work of those areas; and to oversee the formulation and promulgation of company policies and the training of employees in compliance with them.

Communication with ourOur Board

Stockholders and other interested parties may communicate with our directors, including the non-management directors or the independent directors as a group, by writing to our Secretary, Matthew E. Hamel, at 850 Dixie Highway, Louisville, Kentucky 40210, or at Secretary@b-f.com. The Secretary’s office will forward written communications to the individual director or group of directors to whom they are addressed, with copies to all other directors.

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERSBROWN-FORMAN |  | 13 |

CORPORATE GOVERNANCE •COMPANY BEST PRACTICES

Brown-Forman has long believed that good corporate governance is essential to the Company’s long-term success. We continually evaluate our corporate governance practices in the context of our controlled-company status to address the changing regulatory environment, and adopt those practices that we believe are in the best for Brown-Forman.interests of Brown-Forman and all of our stockholders.

Code of Conduct

The Company has adopted the Brown-Forman Code of Conduct which contains our standardsexpresses its expectations of ethical behavior for all of our employees and directors. The Code of Conduct includes our Code of Ethics for Senior Financial Officers, which reflects the Company’s expectation that all of our financial, accounting, reporting, and auditing activities of the Company are towill be conducted in strict compliance with all applicable rules and regulations and underwill conform to the highest ethical standards. Brown-Forman encourages its employees to “speak up” when aware of a potential code of conduct violation and provides multiple channels for doing so, including anonymously. The Code of Conduct, including reporting channels, and the Code of Ethics for Senior Financial Officers can be found on our website atwww.brown-forman.com/about/corporate-governance/code-of-ethics/andwww.brown-forman.com/about/corporate-governance/code-of-ethics-for-senior-financial-officers/.

Disclosure Controls Committee

The Company has a Disclosure Controls Committee which is composed of members of management. This committee has established controls and procedures designed to ensure that information that the CompanyBrown-Forman may be required to disclose is gathered and communicated to the committee and that anyall required disclosure isdisclosures are made in a timely and accurate manner. The committee has implemented a financial review process that enables our Chief Executive Officer and Chief Financial Officer to certify our quarterly and annual financial reports, and also is responsible for developing and implementingas well as procedures designed to ensure our compliance with SEC Regulation FD (Fair Disclosure).

Risk Committee

The mission of the Enterprise Risk Management (ERM) Committee, which is composed of members of management, leads the Company’s enterprise risk management program (ERMP). The objective of the ERMP is to protectensure that all of Brown-Forman’s major risks are identified and evaluated. The ERM Committee also identifies the long-term viability of the Company’s business through the identificationindividuals and management of risk. The ERMP includes the development and implementation of our risk management policies and specific governance structures and the oversight of our processes for identifying, assessing, and mitigating risk. In support of the ERMP’s objectives, the Risk Committee isteams who are responsible for identifying criticalmitigating risks, the Company faces; assessing the adequacy of measuresand ensures that mitigation plans are in place to managemitigate the Company’s significant risks. The ERM Committee reports to the Audit Committee regarding its policies and processes. In addition, the ERM Committee reports to the Board at least annually regarding the top risks facing Brown-Forman, and periodically updates the Board on the mitigation plans related to those risks; communicating the role of all employees in the ERMP; and integrating the discussion of risk into decision-making processes.risks.

| 14 |  | BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE •OUR CONTROLLING FAMILY STOCKHOLDERS

OUR CONTROLLING FAMILY STOCKHOLDERS

As noted above, Brown-Forman has an engaged family stockholder base with a long-term ownership perspective. We view our status as a publicly traded, family-controlled company as a distinct competitive advantage, and we believe that a strong relationship with the Brown family is essential to our growth, independence, and ability to create long-term value creation for all stockholders. The Company conducts its interactionsManagement interacts with Brown family members in a manner consistent with all applicable laws and regulations. We actively cultivate our relationship with the Brown family through a numbervariety of different channels, as detailed below.

Brown-Forman/Brown Family Shareholders Committee

In 2007, Geo. Garvin Brown IV and Paul C. Varga organized the Brown-Forman/Brown Family Shareholders Committee, (FSC), which they continue to co-chair. The FSCThis committee provides a forum for frequent, open, and constructive dialogue between the CompanyBrown-Forman and its controlling family stockholders. It includes several non-family Company executives in addition to Mr. Varga and has formed subcommittees to engage certainThe Brown Family Shareholders Committee engages the Brown family members on topics of mutual interest such as family corporatethe Company and industry, governance, Brown-Forman philanthropy,ownership, and Brown family stockholder education.philanthropy.

Director of Family Shareholder Relations

The Director of Family Shareholder Relations, a Brown-Forman employee, works with Companyother employees and certain Brown family members to develop and implement policies and practices designed to further strengthen the relationship between the CompanyBrown-Forman and the Brown family.

Brown Family Member Employees

The CompanyBrown-Forman employs eleventen Brown family members, at various levels. Some Brown family employeessome of whom participate on Company management committeesteams that oversee strategic and operational matters. Participation on these committees enables our Brown family employees to contribute their perspectives toon the important issues facingwe confront. In addition to their management contributions, the Company.Brown family employees play a critical role in upholding the Brown-Forman corporate culture.

|  | 15 |

| PROPOSAL 1: | ||||

| ELECTION OF DIRECTORS |

This section provides information about our thirteen director nominees, including the experience, qualifications, attributes, and skills that enable them to make valuable contributions to our Board in light of our business and our status as a family-controlled company.Board.

All of our director nominees are current directors of Brown-Forman. Each director was elected by the stockholders at the Company’s 2014our 2016 Annual Meeting except for Stuart R. Brown and Augusta Brown Holland,Kathleen M. Gutmann, who werewas appointed to the Board in May 2015.2017. Kathleen M. Gutmann was recommended for appointment to the Board by the Corporate Governance and Nominating Committee following a process conducted with the assistance of a third-party executive search firm.

The Board unanimously recommends a vote “FOR” the election of each of the director nominees.nominee.

Your shares will be voted“FOR”the election of all director nominees listed below unless you directinstruct the proxy holders to vote against, or to abstain from voting for, one or more of the nominees. If any nominee becomes unable to serve before the meeting, the proxy holders may vote for a substitute nominee if the Board has designated one. As of the date of this Proxy Statement, it is the Board’s understanding thatBoard believes each nominee is prepared to serve if elected.

NOMINEES

| PATRICK BOUSQUET-CHAVANNE | ||||

|

| |||

Director since 2005 Age

Committees:

- Compensation

| CURRENT AND PAST POSITIONS

Positions at Marks and Spencer Group - Executive Director of Customer, Marketing and M&S.com since - Executive Director of Marketing and International from 2014 to 2016 - Executive Director, Marketing and Business Development - Corporate Director of Strategy and Business Development Positions at Yoostar Entertainment - Co-Chairman from 2010 to - President and Chief Executive Officer | QUALIFICATIONS AND SKILLS

- Experience dealing with governance issues relevant to family-controlled public

OTHER - Marks and Spencer Group PLC since - HSNi Corporation from 2008 to

| ||

| CAMPBELL P. BROWN | ||||||||||

Director since 2016 Age 49 | CURRENT AND PAST POSITIONS Positions with Brown-Forman and affiliates: - President and Managing Director of Old Forester, our founding bourbon brand, since 2015 - Led the wine and spirits portfolio in Canada and the Midwest region of the U.S. - Served in the emerging markets of India, the Philippines, and Turkey - Various other positions over a 23-year career - Founding member of Brown-Forman/Brown Family Shareholders Committee since 2007 | QUALIFICATIONS AND SKILLS - Business and industry experience gained by serving in operational, management, and executive positions within the Company - Deep knowledge of family corporate governance - Perspective as a fifth generation Brown family stockholder - A history of service on the Brown-Forman/ Brown Family Shareholders Committee, which demonstrates his ability to represent the long-term interests of shareholders OTHER DIRECTORSHIPS - Republic Bank and Trust Company since 2008 | ||||||||

| 16 |  | BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

ELECTION OF DIRECTORS•NOMINEES

| GEO. GARVIN BROWN IV | ||||||

Director since 2006 Age

Committees:

- Corporate Governance

| CURRENT AND PAST POSITIONS Positions with Brown-Forman and affiliates: - Chairman of the Board since - Executive Vice President - Senior Vice President and Managing Director of Western Europe and Africa from 2009 to - Vice President and Jack Daniel’s Brand Director in Europe and Africa from 2004 to - Director of the Office of the Chairman and Chief Executive Officer from 2002 to - Founding member and Co-Chairman of Brown-Forman/Brown Family Shareholders Committee since 2007 | QUALIFICATIONS AND SKILLS

- Deep knowledge of family corporate governance - Perspective as a fifth generation Brown family - A history of service on the Brown-Forman/ Brown Family Shareholders Committee, which demonstrates his ability to represent the long-term interests of shareholders |

| STUART R. BROWN | ||||

Director since Age |

| |||

|

DendriFund, Inc. Between the Covers Bookstore, Owner from 1998 to Positions with Brown-Forman and affiliates: - Sales and Marketing Management - Founding member of Brown-Forman/Brown Family Shareholders Committee since | QUALIFICATIONS AND SKILLS

- Perspective as a fifth generation Brown family stockholder - A history of service on the Brown-Forman/Brown Family Shareholders Committee, which demonstrates his ability to represent the long-term interests of

| ||

Director since 2010 Age 69 Committees: - Audit - Corporate Governance and Nominating | CURRENT AND PAST POSITIONS Positions with The Procter & Gamble Company: - Vice Chairman of the Board from 2002 to 2008 - Vice Chairman, Global Brand Building Training, from 2007 to 2008 - Vice Chairman, Global Household Care Division, from 2004 to 2007 | QUALIFICATIONS AND SKILLS - Executive leadership of a global consumer goods company - Expertise in brand building, brand management, and finance - Experience with international marketing and operations and corporate strategy OTHER DIRECTORSHIPS - Boston Scientific Corporation from 2009 to 2015 - Diebold, Incorporated from 2010 to 2015 - Cincinnati Bell, Inc. from 2003 to 2013 | ||||||

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERSBROWN-FORMAN |  | 17 |

Director since

Director since 2012

-Compensation -Corporate Governance -Audit -Executive |

- Director from 2003 to | |||

|

- Leadership and senior management experience - Financial and international expertise - Marketing skills - Experience with strategic acquisitions and integrations

OTHER DIRECTORSHIPS - Winona Capital Management since 2007 | |||

| MARSHALL B. FARRER | ||||

Director since Age |

Positions with Brown-Forman and affiliates: - Vice President, Managing Director of Global Travel Retail, which includes Duty Free, Military, Cruise, and Transportation sales globally since 2015 - Led the global Jack Daniel’s Tennessee Honey brand team from 2014 to 2015 - Managing director of the Australia/Pacific region from 2010 to 2014 - Led the Latin America & Caribbean region from 2006 to 2009 - Various other positions over a 19-year career - Founding member of Brown-Forman/Brown Family Shareholders Committee since 2007 - Member of the Brown-Forman Management Executive Committee from 2007 to 2009 | QUALIFICATIONS AND - Business and industry experience gained from serving in operational, management, - Deep knowledge of family corporate governance - Perspective as a fifth generation Brown family - A history of service on the Brown-Forman Executive Committee and Brown-Forman/ Brown Family Shareholders Committee, which demonstrates his ability to represent the long-term interests of shareholders | ||

| LAURA L. FRAZIER | ||||

Age 59 | CURRENT AND PAST POSITIONS Bittners (a more than 160-year-old interior and commercial design firm), Owner, Chairman, and past-CEO Positions with Brown-Forman and affiliates: - Member of the board of directors of Lenox, Inc., a former subsidiary, from 1999 to 2005 - Founding member of Brown-Forman/Brown Family Shareholders Committee since | QUALIFICATIONS AND SKILLS - Executive leadership and - Perspective as a fifth generation Brown family stockholder - A history of service on the Brown-Forman/ Brown Family Shareholders Committee, which demonstrates her ability to represent the long-term interests of shareholders | ||

| 18 |  | |||||||

BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

ELECTION OF DIRECTORS •NOMINEES

| KATHLEEN M. GUTMANN | ||||||

Director since May Age | CURRENT AND PAST POSITIONS

Positions with United Parcel Service: - Chief Sales and Solutions Officer and Senior Vice President of The UPS Store and UPS Capital since 2015 - Senior Vice President of Worldwide Sales and Solutions from 2014 to 2015 - President of Worldwide Sales from 2011 to 2014 | QUALIFICATIONS AND SKILLS - Experience with directing long-term strategy as a member of the UPS Management Committee - Oversight of P&L for UPS Capital, a UPS subsidiary that provides supply chain, financial, insurance, and payment solutions, and The UPS Store, a franchise system of retail shipping, mailbox, print, and business service centers | ||

| AUGUSTA BROWN HOLLAND | ||||

Director since 2015 Age 41 | CURRENT AND PAST POSITIONS - Haystack Partners LLC - Founding member of Brown-Forman/Brown Family Shareholders Committee since | QUALIFICATIONS AND SKILLS

- Experience serving on numerous civic - Perspective as a fifth generation Brown - A history of service on the Brown-Forman/Brown Family Shareholders Committee, which demonstrates her ability to represent the long-term interests of shareholders | ||

| MICHAEL J. RONEY | ||||

Director since 2014 Age

Committees:

- Compensation (Chair) | CURRENT AND PAST POSITIONS Bunzl plc, Chief Executive | QUALIFICATIONS AND SKILLS - Extensive senior management and executive leadership experience - Deep expertise in multinational production, distribution, and operations - Financial expertise - International mergers and acquisitions experience OTHER DIRECTORSHIPS - Next plc since - Grafton Group plc since - Johnson Matthey plc from 2007 to

2005, Non-Executive Director | ||

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERSBROWN-FORMAN |  | 19 |

ELECTION OF DIRECTORS •NOMINEES

| MICHAEL A. TODMAN | ||||

Director since 2014 Age

Committees:

- Audit (Chair) | CURRENT AND PAST POSITIONS Positions with Whirlpool and affiliates: - Vice Chairman, Whirlpool Corporation - President, Whirlpool International from 2009 to - President, Whirlpool North America from 2007 to | QUALIFICATIONS AND SKILLS

- Executive leadership of large multinational - Financial expertise

OTHER - Newell Rubbermaid, Inc. since - Prudential Financial, Inc. since 2016 - Whirlpool Corporation from 2006 to 2015 | ||

| |

| PAUL C. VARGA | ||||

Director since 2003 Age

Committees:

- Executive | CURRENT AND PAST POSITIONS

Positions with Brown-Forman and affiliates: - Chief Executive Officer since - Chairman since 2007 - President and Chief Executive Officer of Brown-Forman Beverages - Global Chief Marketing Officer for Brown-Forman Spirits from 2000 to | QUALIFICATIONS AND SKILLS

- Extensive knowledge of the beverage alcohol - Sales and marketing - Strategic thinking, leadership, management, consensus-building, and communication

OTHER

- Macy’s, Inc. since 2012 | ||

|

|

Family Relationships.relationships. No family relationship—relationship — first cousin or closer—closer — exists between any two directors, executive officers, or personsindividuals nominated or chosen by the Company to become a director or executive officer, except thatfor the following relationships between Brown family directors: Geo. Garvin Brown IV and Campbell P. Brown are brothers, and Marshall B. Farrer is the nephew of Dace Brown Stubbs,their first cousin; and Martin S. Brown, Jr., Stuart R. Brown and Augusta Brown Holland are first cousins.

| 20 |  | |||||||

BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

| DIRECTOR COMPENSATION |

OVERVIEW

Our directors serve one-year terms that begin with their election at an Annual Meeting and end immediately upon the election of directors at the next year’s Annual Meeting (a period weMeeting. We refer to this period as a “Board Year” for director compensation purposes).purposes.

Our non-employee director compensation consists of an annual Board retainer, a Chair of the Board retainer, a Lead Independent Director retainer, committee member retainers, committee chair retainers, and meeting fees. To align the interests of our non-employee directors with those of our stockholders, our non-employee directors receive their Board retainers in a combination of cash and equity. Non-employee directors receive meeting fees only if they attend more than eight meetings (Board), ten meetings (Audit Committee), or six meetings (Compensation Committee and Corporate Governance and& Nominating Committee). The Compensation Committee believes that this compensation structure appropriately reflects the importance of directors’ active participation at Board and committee meetings.

The Compensation Committee reviews, with the assistance of its independent consultant Frederic W. Cook & Co. (FWC) information each year related to the competitiveness of non-employee Director Compensation Structurecompensation and, from time to time, recommends adjustments to its compensation structure to ensure both continued competitiveness and the appropriate compensation. Based upon the review of this information in fiscal 2017, FWC recommended, and the Board confirmed and approved, no changes to the existing retainers and fees listed below.

| DIRECTOR COMPENSATION STRUCTURE | ||||||

| Pay Element | Amount | |||||

| Lead Independent Director Retainer | ||||||

Paid in six installments over the Board Year. | $30,000 | |||||

| Board Retainer | ||||||

Directors who have satisfied our stock ownership guidelines may elect to receive up to 100% of the retainer in cash, including the equity retainer. | The cash retainer is paid in six installments over the Board Year. |

• $70,000 cash

(deferred stock units) | ||||

| Meeting Fees |

director attends more than eight meetings (Board). | Board | $5,000 per meeting | |||

No fee is paid unless the director attends more than ten meetings (Audit) or six meetings (Compensation and Corporate Governance & Nominating) | Audit, Compensation, and Corporate Governance & Nominating | $2,500 per meeting $1,250 per telephonic meeting | ||||

| Committee Member Retainers | Audit | $25,000 | ||||

| Paid in six installments over the Board Year. | Compensation | $ | ||||

Corporate Governance & Nominating | $ | |||||

| Committee Chair Retainers | ||||||

(Audit, Compensation, and Corporate Governance | ||||||

chairs more than one committee, he or she will receive multiple chair retainers. | $20,000 | |||||

| Non-Employee Chair of the Board Retainer Paid in six installments over the Board Year. | $625,000 | |||||

2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERSBROWN-FORMAN |  | 21 |

DIRECTOR COMPENSATION • OVERVIEW

Deferred Stock Units

Our Deferred Stock Unit (DSU) program for non-employee directors allows us to issue both Class A common DSUs and Class B common DSUs. Each DSU represents the right to receive one share of the Company’sBrown-Forman’s Class A or Class B common stock, based on the closing price of the shares on the date the award is made. After a non-employee director’s Board service ends, his or her DSUs are paid out in shares of Class A or Class B common stock following a six-month waiting period. Directors may elect to receive this distribution either in a single lump sum or in ten equal annual installments.

On each dividend payment date, non-employee directors who hold DSUs are credited with additional DSUs equivalent to the cash dividends on the number of shares represented by the DSUs they held on the record date for that dividend. These dividend credits are calculatedconverted to additional DSUs based on the market value of the Class A or Class B common stock as of the dividend payment date.

If a director’s Board service ends during a Board Year, the DSUs attributable to the remainder of that Board Year and any corresponding dividend-equivalent DSUs, do not vest and are forfeited.

Employee Directors

In addition to his regular compensation as a Brown-FormanPaul C. Varga, Campbell P. Brown, and Marshall B. Farrer are our employee we separately paid Geo. Garvin Brown IV $145,000 per year for his service as Chairman of the Board. Beginning in fiscal 2013, the value of this payment was included in Mr. Brown’s target long-term incentive compensation. Otherwise, wedirectors. They do not pay our employee directors (Paul C. Varga and James S. Welch, Jr.)receive any compensation for serving on our Board, any of its committees, or on the boards or equivalent bodies of any of our subsidiaries. For additional information on Geo. Garvin Brown IV’s compensation as a Brown-Forman employee, please see the “Certain Relationships and Related Transactions” section, which begins on page 58.

Stock Ownership Guideline

Our stock ownership guideline for non-employee directors is equal to five times the value of the annual board retainer, (with a current guideline of $875,000).which in fiscal 2017 was $925,000. When considering whether a non-employee director has satisfied the stock ownership guideline, the Compensation Committee includes DSUs as well as Class A or Class B common stock held directly. The value of any unexercised stock-settled stock appreciation rights (SSARs) is not included. Any non-employee director who has not yet met the stock ownership guideline willmust elect to receive at least 60% of his or her annual equity board retainer in DSUs.

Expense Reimbursement

We reimburse all directors for reasonable and necessary expenses they incur in performing their duties as directors. WeIn addition, we provide a travel stipend of $3,000 per meeting to directors who must travel to Board meetings from outside the United States.

Continuing Education Allowance

The CompanyBrown-Forman covers the cost, up to $10,000 per director per Board Year, of continuing education programs to support our directors’ efforts to remain current on best practices in board governance, industry matters, or other business topics relevant to their boardBoard service.

Events

We occasionally invite our directors and their spouses to certain events, including strategy retreats, retirement celebrations, award dinners, and similar events.functions. We believe these occasions provide valuable opportunities for our directors to establish and develop relationships with our senior executives, long-term stockholders, employees, and each other, furthering our objective of having a strong and cohesive Board.board.

| 22 |  | |||||||

BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

DIRECTOR COMPENSATION • FISCAL 2017 DIRECTOR COMPENSATION

FISCAL 20152017 DIRECTOR COMPENSATION

The following table shows the compensation we paid to our non-employee directors for their service in fiscal 2015.2017.

FISCAL 2017 DIRECTOR COMPENSATION TABLE

Fiscal 2015 Director Compensation Table

| Name | Fees Earned or Paid in Cash (1) | DSU Awards (2) (3) | All Other Compensation | Total | Fees Earned or Paid in Cash(1) | DSU Awards(2)(3) | All Other Compensation(4) | Total | |||||||||||||||||||||

| Joan C. Lordi Amble | $ | 85,750 | $ | 175,000 | — | $ | 260,750 | ||||||||||||||||||||||

| Joan C. Lordi Amble(5) | $13,615 | $— | $— | $13,615 | |||||||||||||||||||||||||

| Patrick Bousquet-Chavanne | 75,500 | 175,000 | — | 250,500 | 59,394 | 185,000 | 15,000 | 259,394 | |||||||||||||||||||||

| Martin S. Brown, Jr. | 180,000 | — | — | 180,000 | |||||||||||||||||||||||||

| Geo. Garvin Brown IV | 517,727 | 312,500 | 18,000 | 848,227 | |||||||||||||||||||||||||

| Martin S. Brown Jr.(5) | 45,066 | — | — | 45,066 | |||||||||||||||||||||||||

| Stuart R. Brown | 185,227 | — | — | 185,227 | |||||||||||||||||||||||||

| Bruce L. Byrnes | 125,000 | 110,000 | — | 235,000 | 116,477 | 115,000 | — | 231,477 | |||||||||||||||||||||

| John D. Cook | 111,250 | 175,000 | — | 286,250 | 115,158 | 185,000 | — | 300,158 | |||||||||||||||||||||

| Sandra A. Frazier | 180,000 | — | — | 180,000 | |||||||||||||||||||||||||

| Laura L. Frazier | 172,567 | — | — | 172,567 | |||||||||||||||||||||||||

| Sandra A. Frazier(5) | 45,066 | — | — | 45,066 | |||||||||||||||||||||||||

| Augusta Brown Holland | 85,227 | 115,000 | — | 200,227 | |||||||||||||||||||||||||

| Michael J. Roney | 28,500 | 175,000 | — | 203,500 | 26,061 | 185,000 | 18,000 | 229,061 | |||||||||||||||||||||

| Dace Brown Stubbs | 92,500 | 87,500 | — | 180,000 | |||||||||||||||||||||||||

| Michael A. Todman | 11,651 | 175,000 | — | 186,651 | 115,133 | 115,000 | — | 230,133 | |||||||||||||||||||||

| (1) | Amounts in this column reflect fees earned during fiscal |

| (2) | DSUs represent the right to receive one share of Class A or Class B common stock, and are determined by dividing the cash value of the compensation being paid in DSUs by the closing price of Class A or Class B common stock on the date of grant. DSU awards for the |

| (3) | The aggregate number of SSARs, DSUs, and |

| Name | DSUs Outstanding Class A as of April 30, 2015 | DSUs Outstanding Class B as of April 30, 2015 | Class B SSAR / Options Outstanding as of April 30, 2015 | DSUs Outstanding Class A as of April 30, 2017 | DSUs Outstanding Class B as of April 30, 2017 | Class B SSAR Outstanding as of April 30, 2017 | Class B Time-Based Restricted Stock Units as of April 30, 2017 | |||||||||||||

| Joan C. Lordi Amble | 3,412 | 2,297 | — | 9,179 | 4,252 | — | — | |||||||||||||

| Patrick Bousquet-Chavanne | 4,380 | 5,117 | 47,045 | 15,773 | 10,526 | — | — | |||||||||||||

| Geo. Garvin Brown IV | 12,485 | — | 12,512 | 7,612 | ||||||||||||||||

| Martin S. Brown, Jr. | — | 1,709 | 23,053 | — | 3,163 | 24,494 | — | |||||||||||||

| Stuart R. Brown | — | — | — | — | ||||||||||||||||

| Bruce L. Byrnes | 2,684 | 3,321 | — | 9,747 | 6,831 | — | — | |||||||||||||

| John D. Cook | 4,380 | 5,117 | 21,752 | 15,773 | 10,526 | 43,504 | — | |||||||||||||

| Laura L. Frazier | — | — | — | — | ||||||||||||||||

| Sandra A. Frazier | — | 1,709 | 23,053 | — | 3,163 | 24,494 | — | |||||||||||||

| Augusta Brown Holland | 3,424 | — | — | — | ||||||||||||||||

| Michael J. Roney | 2,499 | — | — | 11,909 | — | — | — | |||||||||||||

| Dace Brown Stubbs | 2,190 | 3,413 | 23,053 | |||||||||||||||||

| Michael A. Todman | 1,959 | — | — | 8,259 | — | — | — | |||||||||||||

| (4) | Reflects taxable travel stipend amounts paid during fiscal 2017 to directors who traveled to Board meetings from outside of the United States. | |||||

| Ms. Joan C. Lordi Amble, Mr. Martin S. Brown Jr., and Ms. Sandra A. Frazier’s service as directors ended on July 28, 2016, at the 2016 Annual Meeting. The amounts set forth under “Fees Earned or Paid in Cash” represent the fees earned for their service for part of fiscal 2017. |

|  | 23 |

| COMPENSATION DISCUSSION AND ANALYSIS |

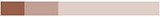

This section describes our executive compensation philosophy and objectives, and programs,the decisions of the Compensation Committee (Committee) regarding the compensation of our Named Executive Officers or “NEOs,” and the factors that contributed to those decisions.(NEOs). For fiscal 2015,2017, our NEOs were:

| Name | Title | |

Paul C. Varga | Company Chairman and Chief Executive Officer | |

Jane C. Morreau | Executive Vice President and Chief Financial Officer | |

| ||

Mark I. McCallum | Executive Vice President, President Jack Daniel’s Brands | |

Jill A. Jones | Executive Vice President, President, | |

| Lawson E. Whiting | Executive Vice President, Chief Brands and Strategy Officer |

Pay for Performance

We believe in pay for performance and we aim to achieve this objective primarily through our short-termshort- and long-term incentive programs. These programs useutilize key performance metrics to compare our performance relative to that of our peers. We prioritizebelieve the use of peer metrics in our incentive plans because we believe that focusing on external measures rather than internal goals:these metrics:

| • | is the clearest way to demonstrate the value |

| • | ensures that we hold ourselves to a performance standard that is as objective as possible; |

| • | reinforces a competitive and innovative mindset among our leadership; and |

| • | ensures that the incentive payments are appropriate. |

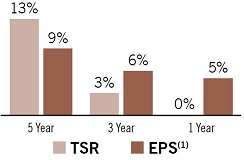

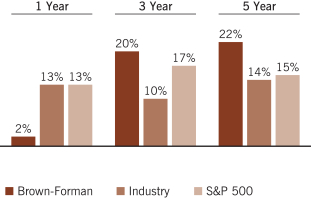

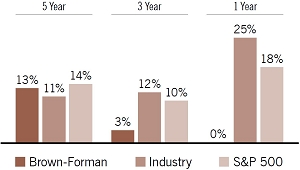

We believe thatone of the best reflectionmeasures of the value that our NEOs bring to the Company created by our NEOs is the return provided to our stockholders relative to the returns of other companies within our industry.

In this respect, our long-term performance has outperformed both companies withinin our industry as well asand the broader S&P 500, as shown in the chartcharts below:

|

| |||

| ||||

|   | |||

| (1) | Compares total shareholder return of Brown-Forman Class B common stock and diluted earnings per share (percent growth over prior fiscal year) with the increase in Mr. Varga’s total compensation (percent growth over prior fiscal year) |

| (2) | Represents the |

| 24 |  | |||||||

BROWN-FORMAN2017 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

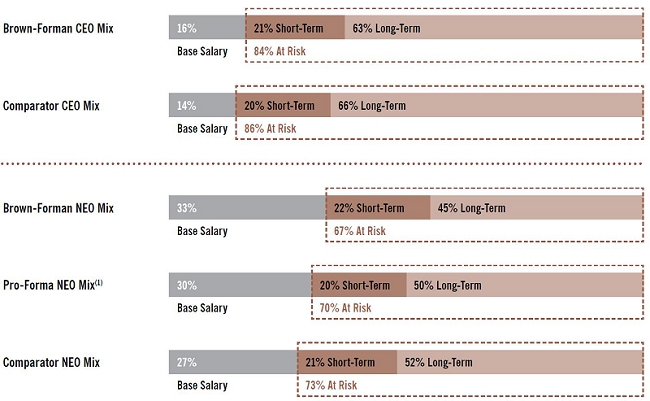

COMPENSATION DISCUSSION AND ANALYSIS • OVERVIEW OF OUR COMPENSATION PROGRAM

As a result of athe Committee’s annual review conducted during fiscal 2015,process, it was determined that the Committee found that total target direct compensation for our CEO and other NEOs was below the market median with the exceptionwhen compared to our compensation peer group listed on page 28. In light of Mr. Welch. Based on this review we believe that our executive compensation program delivers exceptional value to our stockholders, particularly in light ofconsidering the combination of strong returns accompanied by best-in-classand financial performance by the Companythat Brown-Forman and its management team have delivered over multiple years.

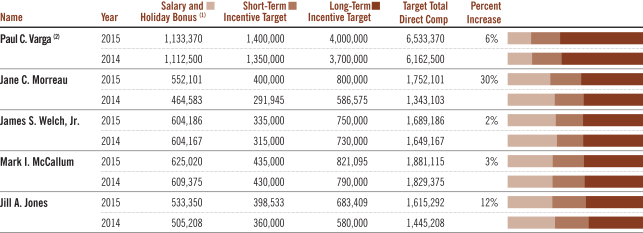

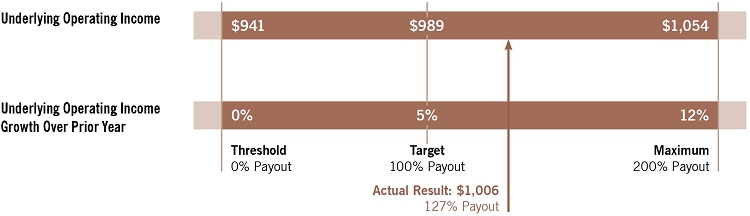

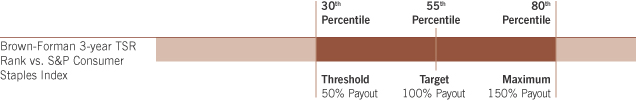

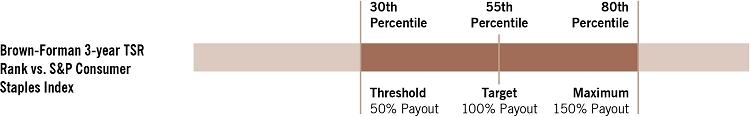

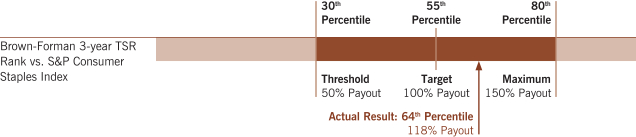

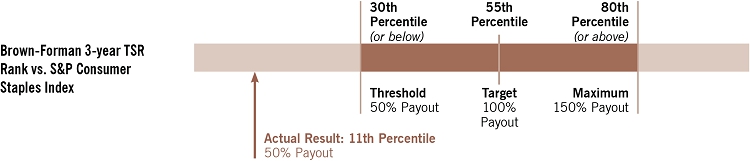

Performance-Based Payouts for Fiscal 20152017

Brown-Forman delivered strong performance in fiscal 2015 with payouts reflecting2017 reflected the alignment ofbetween executive pay with company performance:

CASH INCENTIVEScompensation and Brown-Forman’s performance.

CASH INCENTIVES

| • | We reported |

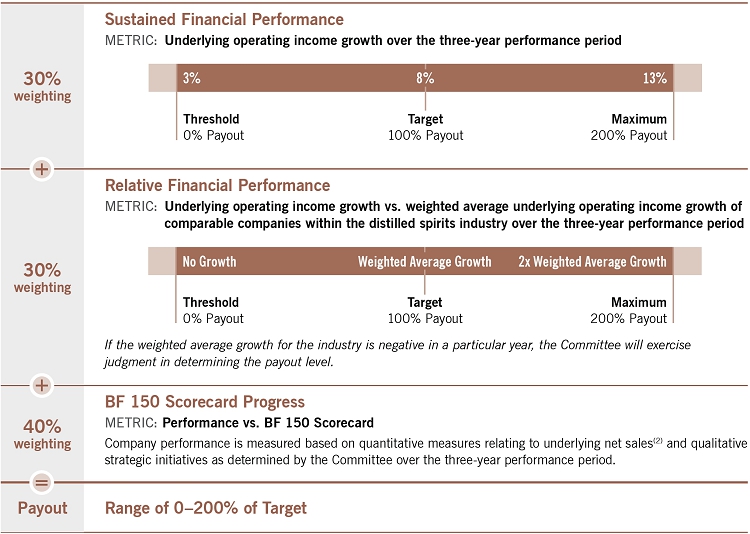

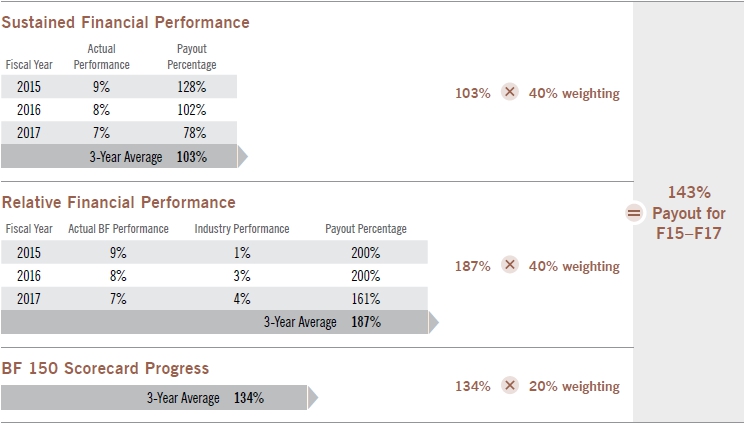

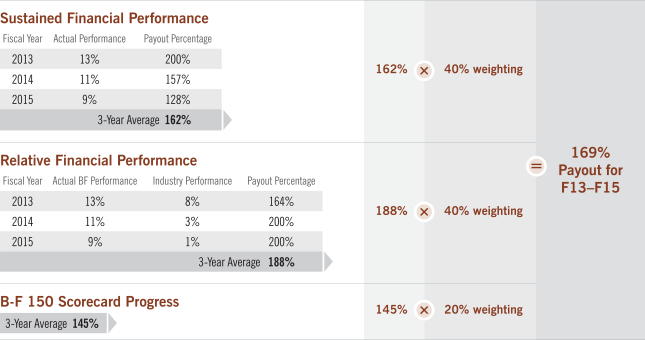

| • | Our long-term cash |

EQUITY-BASED INCENTIVES

We use equity-based incentive compensation as a means of aligningto align the long-term economic interests of our executives with those of our stockholders. We offer our NEOs two types of equity-based incentives: performance-based restricted Class A common stock and stock appreciation rights settled in shares of Class B common stock.

| • | Performance-based restricted stock awards for the fiscal |

| • | Payouts of our stock-settled stock appreciation rights are determined by the increase of our Class B stock price above the awards’ stated grant price. |

Advisory Votes on Executive Compensation

AtIn our first “say-on-pay” vote in our 2014 Annual Meeting, our stockholders voicedexpressed overwhelming support for the compensation of our NEOs, with more than 99% of the votes cast approving the advisory “say-on-pay” resolution. The Committee considered thethese results of this vote as one factorof many factors in its executive compensation decisions for fiscal 2015, 2016, and 2017, and did not make any material changes to the executive compensation program as a result of the say-on-pay vote. program.

Following the expressed preference of our stockholders, the Committee willBrown-Forman expects to continue to conduct future advisory votes on executive compensation every three years, but reserves the right to conduct votes more frequently in order to seek additional feedback from our stockholders.

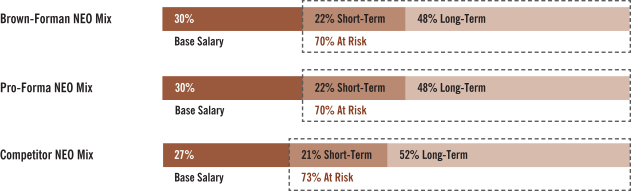

OVERVIEW OF OUR COMPENSATION PROGRAM

Compensation Objectives and Principles

The objective of our executive compensation program is to attract, motivate, reward, and retain a diverse team of talented executives who will lead the CompanyBrown-Forman to produce superior, sustainable and superior long-term value for our stockholders.

Our

As a family-controlled company, our history guides our perspective on executive compensation is informed by our history. As we are a family-controlled company, memberscompensation. Members of the Brown family have historically served as our senior leadership, and their compensation was modest by competitive market standards. ThisWhile this was not a major concern at the time given their significant stock holdings, as increases in the value of Brown-Forman’s stock and the payment of dividends were considered to be the most important forms of compensation for Brown family members.